No one should act on such information without appropriate professional advice after a thorough examination of the particular situation. For taxpayers with provisional income above these thresholds, up to 85 of social security is taxable under federal law. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. taxable income not over 15,000: 3.1 (79-32,110) taxable income over 15,000 but not over 30,000: 465 plus 5.25 of excess over 15,000 (K.S.A.

The annual rate is based on the average monthly prime rate during the preceding twelve month period, October through.

#FEDERAL TAX BRACKETS 2021 OVER 65 CODE#

Iowa Code Section 421.7 specifies the procedures for calculating the Department’s annual and monthly interest rates. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Starting January 1, 2021, the interest rate for taxpayers with overdue payments will be: 0.016438 daily. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. For example, a single 64-year-old taxpayer can claim a standard deduction of 12,950 on his or her. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. When you turn 65, the IRS offers you a tax benefit in the form of a larger standard deduction.

#FEDERAL TAX BRACKETS 2021 OVER 65 LICENSE#

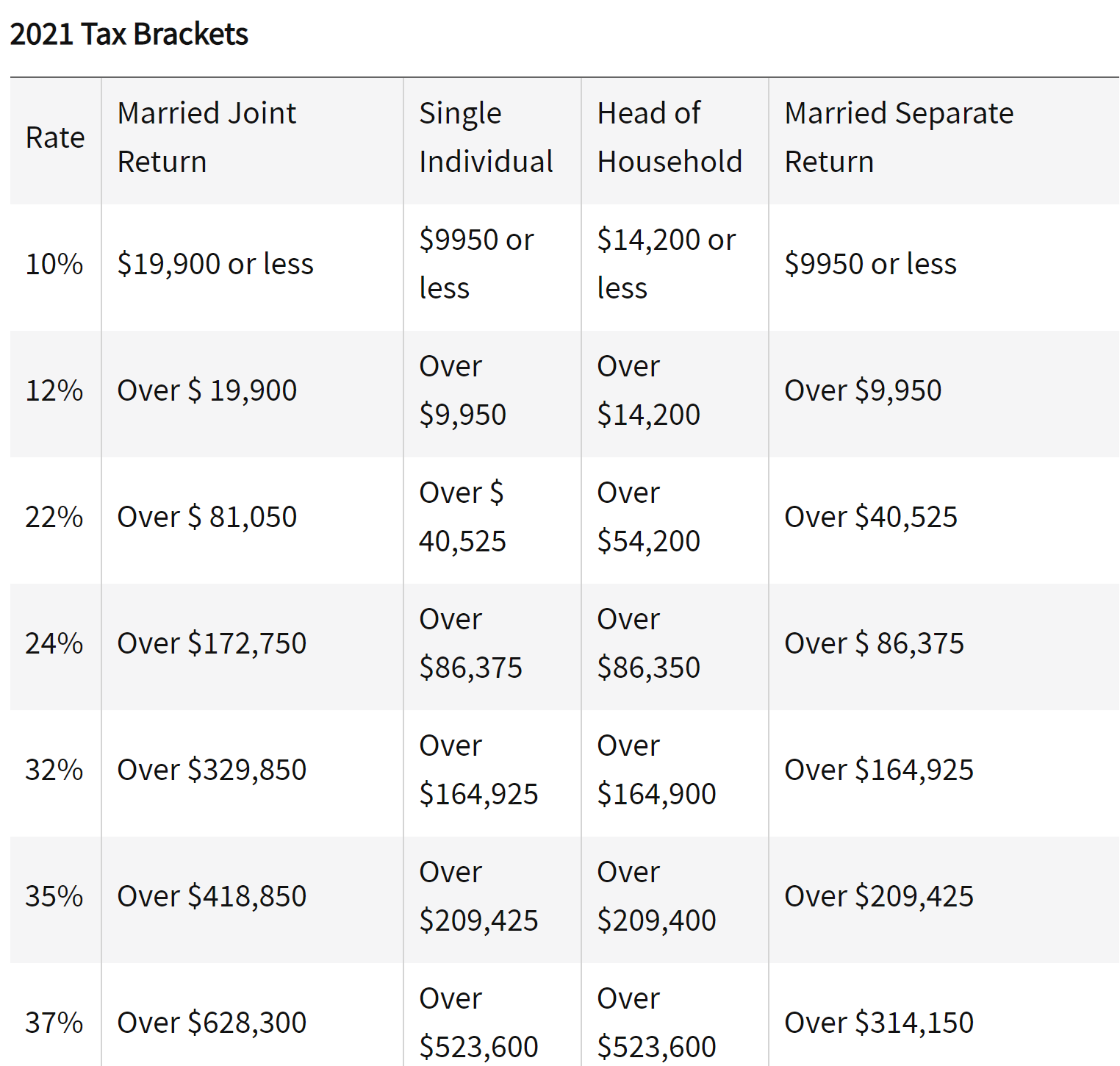

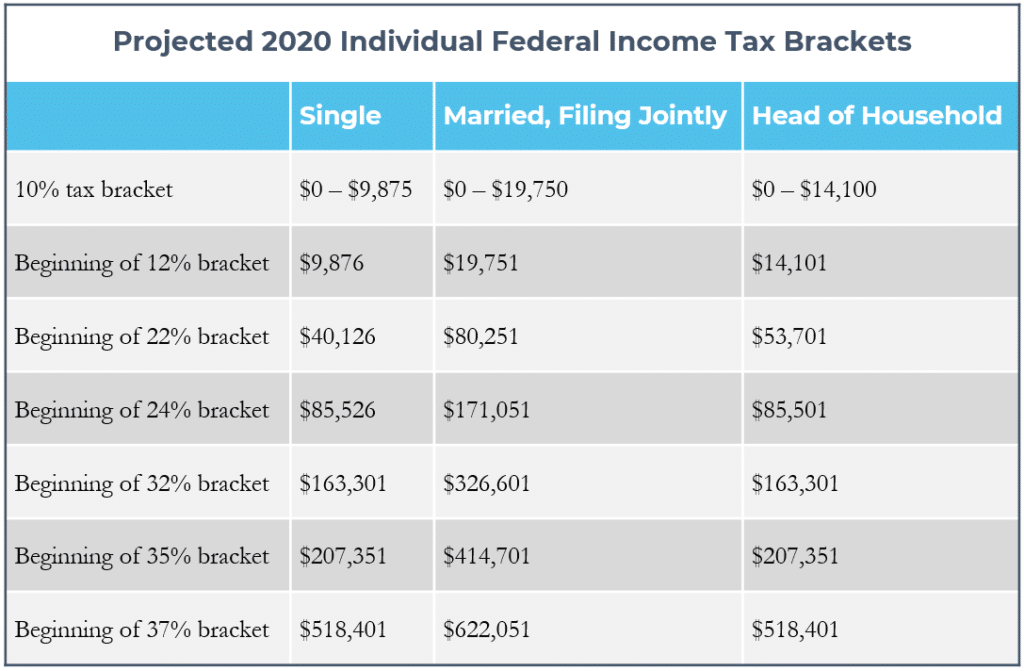

The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. The Federal tax brackets and personal tax credit amounts are increased for. Per IRS/State regulation - not - a Minnesota state tax. The Ontario tax brackets and personal tax credit amounts are increased for 2023 by an indexation factor of 1.065 (6.5 increase), except for the 150,000 and 220,000 bracket amounts, which are not indexed for inflation.

Prepare and e-File your current Minnesota Income Taxes here on together with your Federal Income Tax Return. A List of 20 Tax Forms For The State of Minnesota. GMS Flash Alert is a Global Mobility Services publication of the KPMG LLP Washington National Tax practice. The first thing you need to know about federal tax brackets and income tax rates is that there are seven federal income tax rates. MN or Minnesota Income Tax Brackets, Standard Deductions by Tax Year.

0 kommentar(er)

0 kommentar(er)